Welcome to Trending Now! In this post, we are going to bring you a list of the top 8 best loan apps in Nigeria. We will discuss what makes them the best and also cover everything you need to know about loan apps.

A lot of people keep asking questions like, What is the best app to borrow money in Nigeria? How can I get a fast loan in Nigeria? Which app gives the highest loan instantly in Nigeria? etc., and that leads us to this article. So if you are among the buddies willing to know this, continue reading; you are in the right place!

Best Loan Apps In Nigeria

Borrowing money on apps is one of the best developments of recent days. This development has helped many people settle their problems or even start businesses.

You can remember that during the COVID-19 outbreak, these loan apps were one of the major sources sustaining many people in Nigeria and other parts of the world; hence, there was a lockdown.

One good aspect of it is that some of these digital lending apps grant quick and instant loans without any form of paperwork.

If you are here, I believe that you have an interest in borrowing money, but you want to know which of the digital lending apps is the best in Nigeria.

Well, you are not alone; many people are willing to know this, and I think that’s the first thing to consider if you want to borrow money from apps because most of these loan app lenders are fake, they are not what they claim to be.

We call them loan sharks because they are specially designed to scam poor and innocent souls who are unfortunate enough to be victims.

It will even interest you to know that the number of fake loan apps in Nigeria is rapidly increasing. So it’s a good idea to know the difference between those fake loan apps and the best ones in order to avoid being a victim.

To illuminate this, we have written an awesome article about the Complete List Of Fake Loan Apps In Nigeria. Here, you will understand so many things, like how to identify fake loan apps in Nigeria and other aspects you need to know about fake digital lending apps.

You May Also Like:

- How To Borrow Money From Opay

- Banks That Give Instant Loans In Nigeria

- Okash Loan App: How to Download and Get Your Loan in Minutes

- Top 7 Best Loan Apps in Ghana

Top 8 best loan apps in Nigeria

Below are the top 8 best loan apps in Nigeria:

1. Branch

The branch loan app is among the top digital lending apps in Nigeria and Africa at large. The loan app came into existence in 2015 and started operating in Nigeria in 2017.

As of now, Branch has over 1.2 million users and loan disbursements worth more than 10 billion Naira only in Nigeria.

It’s a CBN-licensed financial institution, and aside from that, people who use the loan app are crediting them for their good service.

Here are some of the powerful features:

- You can build credit as you go

- You can get what you need on the go

- You can invest and earn up to 20% interest

- Reliable transfers from your wallet

- You can pay bills with the app

- No late or rollover fees

- No collateral

- No hidden fees.

The branch loan app offers loans from 2,000 Naira to 500,000 Naira. Their loan duration ranges from 9 to 52 weeks and interest rate ranges from 17% to 40%, with an equivalent monthly interest rate of 1.5% to 20% and APR of 18% to 260%, depending on the kind of loan you are interested in.

How to borrow money Branch loan app

To borrow money from the Branch Loan app, follow the simple steps below:

- Install the app from Play Store or click here to download

- Create your account

- After creating the account, you can apply for a loan that matches your needs.

- Wait for approval within 24 hours.

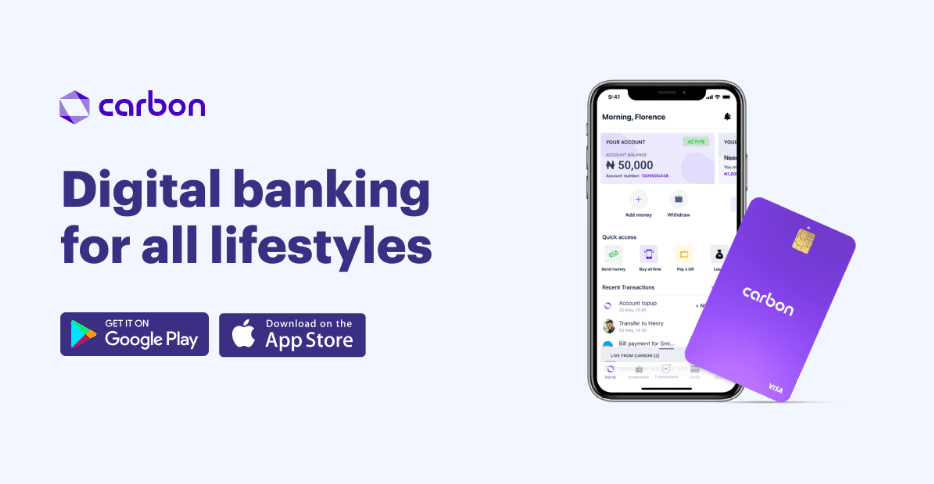

2. Carbon (Paylater)

Another one on the list of the 8 best loan apps in Nigeria is the Carbon (Paylater) loan app.

With this app, you can access a variety of financial services, from high-interest savings to instant short-term loans to settle your urgent needs.

Carbon can even offer you up to a million Naira, but just like other digital lenders, it usually starts low. As you pay back, you get access to a higher amount.

These are the common features:

- You can store your money with convenience in a Carbon bank account

- You can save on carbon and earn returns

- All your payments are in one place

- You can make payments online and offline with cards.

- Carbon allows users to keep track of their credit history

- Instant loan

The app is available on both the Play Store and the Apple Store, or you can click here here to download it and start enjoying the services.

You may also like: Easybuy Phones, Prices, And Websites

3. AellaCredit

AellaCredit cannot be left out of the top 8 best loan apps in Nigeria! It is a CBN-licensed financial institution where users can access loans, pay bills, and save.

Just like other digital lending apps mentioned above, AellaCredit grants quick and instant loans without any form of paperwork.

The basic information needed to access a loan on this app is your bank verification number (BVN), full name, email, phone number, and other information if possible.

AellaCredit offers loans ranging from 2,000 Naira to 1.5 million Naira. Their loan duration ranges from 61 days to 365 days, with a monthly interest rate of 2% to 20%.

You can install the app from the Play Store or Apple Store, or click here to access the platform and start enjoying the services.

4. QuickCheck

Quickcheck is another wonderful loan app that focuses on increasing access to credit for individuals, microentrepreneurs, and business owners to solve their financial needs.

The app offers loans ranging from N1,500 to N500,000, but the highest amount you can borrow as a new user is N10,000. As you pay, you will get access to a larger amount.

Quickcheck normally processes their loans within 24 hours. Their interest rate ranges from 2% to 30%, with an equivalent monthly interest rate of 1% to 20%.

Click here to access and download the app, or you can head over to the Play Store or Apple Store to install the app and start enjoying its amazing features.

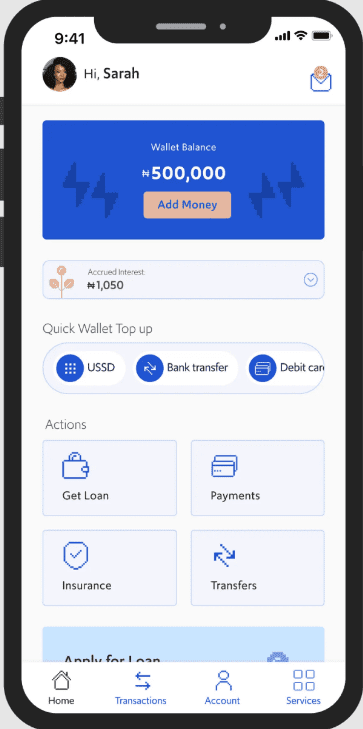

5. PalmPay

Palmpay is also among the top 8 best loan apps in Nigeria!

Just like we explained in our previous post, Palmpay is a simple e-wallet and secure online payment platform that offers financial services to users through its app.

It’s a CBN-licensed e-wallet and mobile payment platform that lets users send and receive quick cash across the country. It’s also used to perform other financial activities like buying airtime, paying utility bills, etc.

With all these amazing features, Palmpay also allows users to borrow money on the platform. The good news is that some of the loans on the platform are interest-free!

We have covered a complete guide on how to borrow money from Palmpay. You can go through the article to understand it better.

6. PalmCredit

With Palmcredit, you can get an instant loan without collateral. You can also enjoy a flexible repayment plan and favorable interest rates.

This loan app is owned by Newedge Finance Limited, a CBN-licensed institution established in 2019.

They offer loans ranging from 10,000 to 300,000 Naira. The loan duration is between 91 and 365 days, and the interest rate is between 14% and 24%.

The app is available on the Play Store and Apple Store, or better yet, you can click here to download it and start enjoying its amazing features.

Also Check: Top 15 Fintech Companies in Nigeria: Best Options to Explore

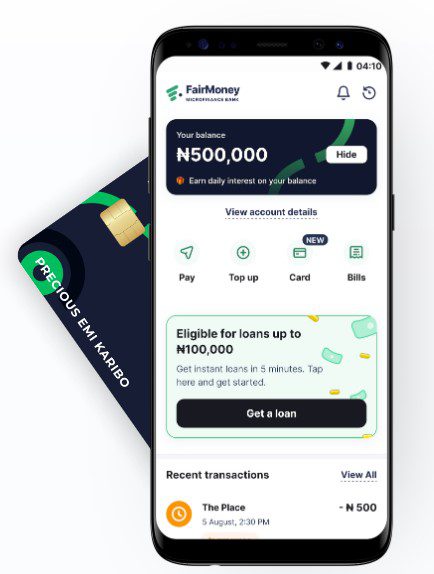

7. FairMoney

FairMoney is another awesome digital lending app where borrowers can get instant and favorable interest rates on loans to solve their financial needs.

The app was founded by Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat on October 1, 2017. The headquarters in Nigeria is located at No. 28 Pade Odanye Close, Off Adeniyi Jones, 101233, Ikeja.

Without a doubt, Fairmoney is among the most popular loan apps in Nigeria, with over 1.3 million users and over 10,000 loan disbursements per day.

Here are the important things you should know about Fairmoney:

- Their loan ranges from 1,500 to 1 million Naira, with repayment periods ranging from 61 days to 18 months.

- Their monthly interest rate ranges from 2.5% to 30% (APRs of 30% to 260%).

- No collateral

- Instant loans

- No hidden fees.

8. KiaKia

The last loan app on the list of the top 8 loan apps in Nigeria is KiaKia!

Just like other loan apps discussed above, you can access a loan from the app without collateral or any form of paperwork.

KiaKia is tested and trusted by many users. It was also awarded as the best peer-to-peer platform in Nigeria in 2019.

They offer loans ranging from 10,000 Naira to 200,000 Naira with a minimum duration of 7 days and a maximum of 30 days.

Summary of the Top 8 best loan apps in Nigeria

- Branch

- Carbon (Paylater)

- AellaCredit

- QuickCheck

- PalmPay

- PalmCredit

- FairMoney

- KiaKia

Best loan apps in Nigeria: Conclusion

The development of digital lending apps has helped a lot of people to settle their financial problems or even start-up businesses, but just like we previously stated, it’s important to know the difference between those fake loan apps and the best ones to avoid being a victim of loan sharks.

The loan apps listed above have been tested and trusted by many users, but it’s advisable to carefully study them and their terms and conditions before giving them a trial.

We will keep updating this article for further developments. Thanks for your time!

Source: TrendingNow.ng

14 comments