Welcome to Trending Now! Do you want to borrow money from Opay but don’t know how to go about it? If the answer is yes, then you are in the right place! This article contains the ultimate guide on how to borrow money from Opay.

We kindly advise you to go through this article without skipping any part to be fully aware of all the important things you need to know about borrowing money from Opay.

Table of Contents:

- About Opay

- Opay Loan (Okash Loan)

- Opay Loan (Okash Loan) Requirement

- Opay Loan (Okash Loan) Interest Rate

- How To Borrow Money From Opay (Okash Loan)

- How to Borrow Money from Opay on iPhone

- How to Borrow Money From Opay Without BVN

- How to Borrow Money From Opay Video

- Opay Loan (Okash Loan) USSD Code

- Frequently Asked Questions

- Conclusion.

About Opay

I believe you know what Opay is all about because it’s a very popular platform, but for better understanding, let me still explain.

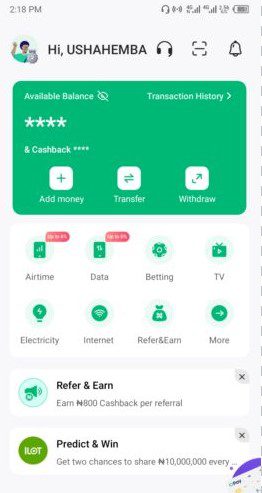

OPay Digital Services Limited is a comprehensive mobile-based financial technology company that provides a wide range of financial services to users.

The platform was established in 2018 by Opera Norway AS Group and is currently operating in various countries, including Nigeria, Mexico, Egypt, and Pakistan.

Opay currently has more than 18 million registered app users and 500,000 agents in Nigeria. Their services are no doubt top-notch and easy to use, attracting more users on a daily basis.

With Opay, you can send and receive money, buy airtime, buy data, pay your TV subscription, pay your electricity bills, and more.

Knowing this, let’s ride!

Opay Loan (Okash Loan)

Loans are one of the major services offered by Opay. They launched this option to help their users handsomely access funds to meet their financial problems.

Just like PalmPay loan, Opay loans are easy to apply for and have flexible repayment terms, making them an attractive option for many individuals and businesses.

With Opay loans, you can access a minimum of N3,000 and a maximum of N50,000 within minutes with no documentation. Their loans are accessible via the OKash loan mobile app, a subsidiary of OPay.

Opay Loan (Okash Loan) Requirement

There are specific eligibility criteria that users must meet before they can qualify for Opay loans, just like on any other loan platform. These requirements are put in place to ensure that borrowers can repay the loan as agreed and to protect both the borrower and the lender.

Below are the eligibility criteria to qualify for Opay loans:

- You must be 20–55 years old

- You must have a valid means of identification

- You must have a valid bank account and card

- You must provide a Bank Verification Number (BVN)

- You need to have a valid email.

Opay Loan (Okash Loan) Interest Rate

The interest rate for Opay Loans (Okash Loans) varies depending on the loan amount and loan term. For instance, they charged 1.2% per day for a fixed term of 15 days.

You May Also Like:

- Top 8 best loan apps in Nigeria

- 7 Best Loan Apps Without BVN In Nigeria

- Banks That Give Instant Loans In Nigeria

How To Borrow Money From Opay (Okash Loan)

Borrowing money from Opay is pretty simple. This can be done in two ways: via the Okash Loan App or using a USSD code.

Below are the steps to successfully borrow money from Opay via the Okash Loan App:

Step 1: Download the app

To start, you have to download and install the Okash Loan App from your mobile app store. The app is available for both Android and iOS devices.

Step 2: Create an account

After getting the app available on your device, open it and register (if you do not have an account) by providing an active phone number and creating a password. You’ll also need to verify your account with a one-time password sent to the phone number you provide.

Step 3: Complete your profile information

Upon creating an account, you have to complete your profile information by providing your basic information and relationship contacts. Make sure your name and date of birth correspond with your bank details to avoid having your loan declined. You must also provide other information like your Bank Verification Number (BVN), email, address, marital status, employment details, and monthly income.

Step 4: Give access and permission

As part of the evaluation process, OKash will require access to certain features of your mobile device, including but not limited to contacts, location, SMS, calendar, and camera. This will enable them to estimate a loan offer that is best suited to your needs. Please note that this step is crucial in determining your eligibility for a loan.

Step 5: Link your card

Okash will also ask you to provide your card details. In general, loan apps typically ask for bank card details to verify the identity of the borrower and facilitate loan payments. By providing your bank card details, the loan app can confirm that you are who you say you are and that you have the means to repay the loan.

Also, loan apps may use your bank card details to set up automatic loan payments or to collect loan payments if you fall behind on your payments. This can be a convenient way to ensure that you don’t miss any payments and that your loan stays in good standing.

To avoid issues relating to card decline, make sure you activate your card for online transactions, input the correct details (i.e., the card number, expiration date, and CVV), and don’t use a card already used by another OKash customer. Finally, make sure you have sufficient funds on your related bank card. A sum of ₦15 will be deducted from the bank card for setup.

Step 6: Provide your bank account

Okash will also ask you to provide the bank account where your loan will be disbursed.

Step 7: Choose your loan amount and submit your loan request

Okash asks borrowers to choose the loan amount as it helps them make informed decisions and offers customized loan products that suit their customer’s needs.

Note that OKash utilizes information from your mobile device, financial transaction records, loan purpose, credit scores, and other information to determine a suitable loan amount you can have for the first time. As you pay, you get access to a higher amount.

All you have to do is choose the loan offer, click submit, and the money will be credited to your account in minutes.

Also Check: How To Borrow Money From PalmPay

How to Borrow Money from Opay on iPhone

Borrowing money from Opay on an iPhone is straightforward. All you have to do is download and install the Opay app from the App Store on your iPhone. After that, follow the steps above to access your loan in minutes.

Alternatively, you can use the USSD code, which is *955#, but don’t forget that this code can only work when you have an account with the platform.

How to Borrow Money From Opay Without BVN

Currently, Opay does not provide an option for users to borrow money without providing a Bank Verification Number (BVN).

Kindly note that Opay and other digital lenders require a BVN to access their lending services. This is because the BVN is a mandatory requirement by the Central Bank of Nigeria (CBN) for all financial transactions in the country.

Therefore, to borrow money from Opay, you need to have a BVN. You can get a BVN by visiting any bank branch or enrollment center in Nigeria.

Once you have a BVN, you can create your account on the Opay (Okash) platform and apply for a loan in minutes.

How to Borrow Money From Opay Video

Coming soon…

Opay Loan (Okash Loan) USSD Code

To borrow money from Opay (Okash Loan) using a USSD code, simply dial *955# on your mobile phone and follow the instructions to get your loan. Note that this can only work if you have an account with the platform.

You can click here and follow up on the easy step-by-step guide on how to open an Opay account.

How to Borrow Money From Opay: FAQS

Below are some of the questions people asked about the Opay loan and their answers:

Does Opay Give Loan?

Yes, Opay gives loans. However, their loans are not directly accessible on their platform but via the Okash OKash loan mobile app, a subsidiary of OPay.

How Much Can I Borrow From Opay For the First Time?

Opay makes use of a variety of methods to determine the loan amount to give borrowers for the first time. Some of the most common factors they consider are your credit score, income, employment history, debt-to-income ratio, and repayment history.

They also utilize information from your mobile device and consider your loan purpose to determine a suitable loan amount you can have for the first time.

In general, the minimum amount of money you can borrow from Opay for the first time is N3,000, and the maximum is N50,000.

How To Borrow Money From Opay: Conclusion

Borrowing money from Opay can be a quick and convenient way to get cash in hand when you need it. However, before taking out a loan, make sure you read and understand the app’s privacy policy and the terms and conditions of the loan, including the interest rate, fees, and repayment period.

Also, consider the purpose of the loan and whether it is a wise financial decision. Are you borrowing the money for emergency purposes or to invest in something that will generate income? You have to check whether the goal is worth it. Borrowing money for non-essential expenses may not be the best idea, as it can put you under undue financial stress.

Lastly, make sure you plan to repay the loan within the due period. If you cannot make the repayments, you could end up in debt and damage your credit score.

Source: TrendingNow.ng

25 comments

I am glad to be a visitant of this gross web blog! , thanks for this rare info ! .

poa92l

There is clearly a lot to realize about this. I believe you made some good points in features also.

I urgently needed a loan to start a business…

Dear Nimson Kausu, you can install the Okash Loan app and follow the steps we discussed above to borrow money from Opay (Okash Loan). Thank you.

Good evening sir am 19 years old am a graphics designer i won borrow money to buy a new phone because i don’t have an android phone as am speaking to you sir and and a laptop to further my work

Dear Mosadioluwa, you can install the Okash Loan app and follow the steps we discussed above to borrow money from Opay (Okash Loan). Thank you.

Hey sir my name is ogunsina toheeb am 22 years old am a student are won borrow money continue my work

Dear Ogunsina, you can install the Okash Loan app and follow the steps we discussed above to borrow money from Opay (Okash Loan). Thank you.

[email protected]

[email protected]